CoreLogic Analysis Shows 200,000+ Texas Homes at Risk of Storm Surge Damage from Hurricane Harvey

Reconstruction Cost Values Total Almost $40 Billion

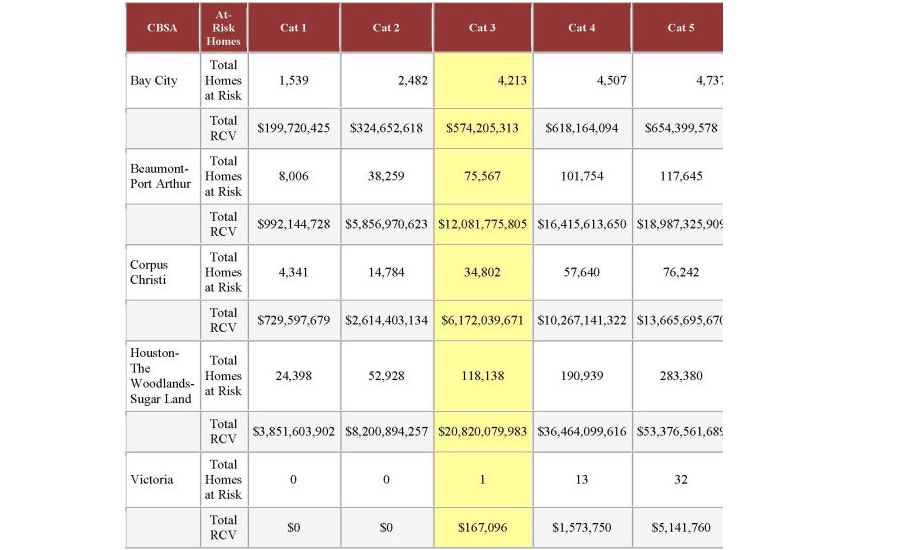

CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, released data analysis late Thursday evening which shows that 232,721 homes along the Texas coast with a reconstruction cost value (RCV) of approximately $39.6 billion are at potential risk of hurricane-driven storm surge damage from Hurricane Harvey, based on Category 3 predictions. Current projections do not expect Hurricane Harvey to exceed a Category 3 storm.

The table above shows the total number of properties at risk of storm surge damage for each of the five hurricane categories as well as the accompanying RCV for the Core Based Statistical Areas (CBSAs) located along the Texas coast that could potentially be affected. The RCV is the cost to completely rebuild a property in case of damage, including labor and materials by geographic location, assuming a worst case scenario at 100-percent destruction.

METHODOLOGY

The analysis encompasses single-family residential structures less than four stories, including mobile homes, duplexes, manufactured homes and cabins, among other non-traditional home types. This does not infer that there will be no damage to residential units greater than four stories, as there may be associated wind or debris damage. However, including all high-rise residential units in the CoreLogic analysis would inaccurately inflate the number of homes at risk of storm surge flooding by including homes that elevated above the potential for damage from surge waters.

ABOUT CORELOGIC

CoreLogic (NYSE: CLGX) is a leading global property information, analytics and data-enabled solutions provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific.

CoreLogic: More than Half of Houston Properties at Moderate to High Flood Risk Not in Designated Flood Zones