6 Things to Know to Get Paid for Sewage Claims

Article written by David J. Dybdahl

This is the third in a series of articles on how to get paid for insured restoration work. The first two articles focused on accelerating payments from insurance companies and from banks holding two-party checks in escrow, mostly in homeowners insurance claims.

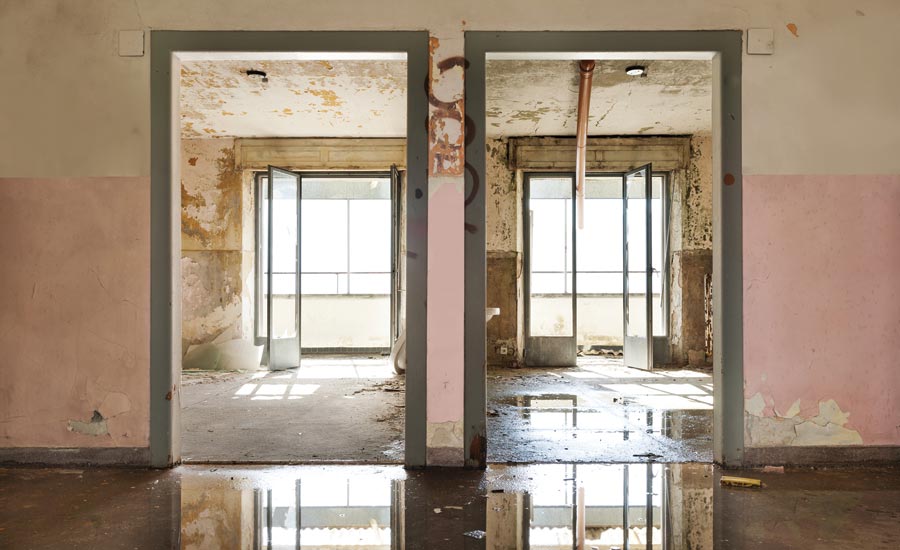

This article focuses on getting paid for water losses on commercial property. The writing is on the wall; it will become increasingly difficult to be fully paid for jobs involving a speck of mold/bacteria or Category 3 water in the future if the property is not insured under a specially designed Environmental Impairment Liability (EIL) insurance policy. Restoration firms providing Emergency Response Plans to the commercial property owners and management firms in their area can cut the costs of this needed insurance by half.

Changes in claims payment practices combined with universal exclusions for restoration work involving fungi/mold/bacteria have created the situation where 99% of all commercial property owners are severely underinsured for any loss involving a speck of any type of mold or bacteria in any sequence in the job. Being underinsured creates problems in getting paid when a property owner is dependent upon insurance to pay for a loss.

The good news for remediators is 99% of claims adjusters do not know how to pay for claims when there is a sublimit on the policy for mold or bacteria-related losses. The result is that uncovered claims for losses involving a speck of mold or bacteria have been routinely paid for the last 12 years. However, things are changing fast in the claims business. Today, there is a much higher chance that a remediator will be left holding the bag with bad debt for the work performed for an underinsured property owner or manager.

Here are six factors to consider to assure payment for mold or bacteria-related (Category 3) water jobs:

- Get an Emergency Response Plan in place with the commercial property owner, or manager. This will give you the opportunity to look at the insurance coverage on the building before you have performed $250,000 in work. Having an account receivable of $250,000 is a really bad time to be figuring out what a $10,000 mold and bacteria sub-limit of coverage on a property insurance policy is all about. Virtually all property policies have a sublimit of some amount for these materials.

- In reviewing the insurance on a building, look to the mold and sometimes bacteria sublimit of coverage in the property insurance policy. The sublimit is the maximum amount you should expect insurance to cover for the work you do on a loss involving a speck of fungus /mold/bacteria or Cat 3 water.

- In the absence of an environmental insurance policy that specifically insures mold and/or bacteria-related losses, it is safe to assume that the mold or bacteria sublimit on the property will be the total amount of money available to pay your restoration bill. The most common sublimit amount for mold and bacteria on a commercial property policy is only $10,000.

- There may be separate coverage for the back-up of a sewer or a drain, which will directly conflict with the bacteria or pollution sublimit in the policy. For clarification on which amount of coverage applies, ask the insurance agent who sold the policy. Inform the insurance agent that Category 3 water is Category 3 water because of the bacteria in the water. And that all drain pipes contain category 3 water, which will help the agent evaluate how much coverage there is for a Cat 3 water loss on the building. Do not be surprised if the insurance agent has never heard of Category 3 water. It would be wise to not trust the insurance advice of an insurance agent who has never heard of Category 3 water before you asked questions about the coverage for it.

- If the building is covered under an EIL-type policy, check to see that all types of bacteria (not just the type of bacteria that causes Legionnaires disease) are covered. If the property insurance policy excludes all losses involving a speck of any type of bacteria, and millions of policies do, and the EIL policy only covers literally one out of the million known forms of bacteria, the chances of getting a Category 3 water loss paid for under the environment insurance policy could be one in a million. There are environmental insurance policies that work a million times better for Category 3 water and cost the same as the less reliable policies.

- For the reasons detailed below, it is a really good idea to encourage all of your commercial property owners to have EIL insurance in order for you to have a reliable source of payment for the work you do on a job involving mold or bacteria related losses. Your services in preparing an Emergency Response Plan can potentially reduce the cost of EIL insurance on a commercial building by half the premium. That fact alone should encourage customers and prospects into getting Emergency Response Plans in place.

The good news for remediators is 99% of claims adjusters do not know how to pay for claims when there is a sublimit on the policy for mold or bacteria-related losses.

IS ALL THAT REALLY NECESSARY?

I know readers by this point will be thinking: why such a radical change in the process of figuring out if there a property insurance policy in place to pay my charges? And… what is the deductible amount that I need to get paid by the owner?

The answer has a lot of moving parts to it. But in its simplest form, if the property insurance policy has a mold and sometimes a bacteria-related loss sublimit of coverage on it, and they all do, the total amount you should be paid on a job involving the clean-up of a speck of any type of mold or bacteria, in any sequence to the work performed on the job, is the amount mold/bacteria sublimit.

If you have been getting paid for more than the sublimit for all the work performed on a job involving cleaning up a speck of mold or bacteria in any sequence in the loss, the claims adjuster has set the insurance company up for a battle with angry shareholders. Claims adjusters have been setting up insurance companies for these kinds of problems in mass since 2005; and that has been really good for restorers.

Splitting the mold work out from the water work is not how the sublimits operate by the words in the property insurance policy.

Claims adjusters since 1943 have routinely paid mold claims under the total limit of liability on the property policy if the mold was a result of an otherwise covered cause of loss.

Starting around 2005 when mold/bacteria sublimits were slammed into property insurance policies claims, adjusters started to segregate out the mold work from the water work and capped the payment for the mold work part of a job at the mold/bacteria sublimit on the policy. That was a nice way to handle the imposition of universal mold exclusions and sub-limits in insurance policies. It is also an inaccurate approach to the way mold and bacteria-related claims should be adjusted in strict adherence to the words in the policy.

Splitting the mold work out from the water work is not how the sublimits operate by the words in the property insurance policy. Ignoring that water may be laced with bacteria and adjusting all claims as simply a “water loss” is also technically inaccurate. The actual sublimits for mold and sometimes bacteria in property liability insurance policies technically apply to all the work at the job site, job not just the part of the job involving mold and bacteria clean up.

THIS IS NOT A NEW CONCEPT

These sublimits are not a new concept in insurance. What is new is claims adjusters actually using the sublimits to cap their loss payouts

The restrictions for mold and bacteria-related damages under property and liability insurance policies were set in motion in the insurance business in 2005. In response to the “Toxic Mold” media frenzy and the resulting “Mold is Gold” seminars for plaintiff’s lawyers, insurance companies implemented their risk management strategy which was to stop bleeding money on mold claims. To do that, insurance companies excluded or added a very low sublimit of coverage for mold-related damages on every type of insurance policy except worker’s compensation insurance. Some insurance companies even put mold exclusions into automobile insurance policies.

To make sure insurance companies do not end up paying for mold claims as bacteria contamination claims, the drafters of mold exclusions expanded the definition of mold to include fungi or bacteria. The drafters of the exclusions knew that everywhere mold is found, bacteria will be found trying to eat the mold as a food source. Not wanting to deal with this claim scenario, the simple solution for the writers of mold exclusions was to totally exclude or severely limit the number of insurance limits available to pay for mold and bacteria-related damages.

It is highly likely that none of the people involved with creating mold exclusions in 2004 had ever heard of Category 3 water, which turns out to be a major loss exposure in commercial buildings. By excluding bacteria, they ended up eliminating coverage for Category 3 water.

The restrictions for mold and bacteria-related damages under property and liability insurance policies was set in motion in the insurance business in 2005.

Change is here. We’ll continue talking about this change, what it means for you the restorer, and your customers, in the January issue of R&R.

A continuing conversation on getting paid, working with mortgage companies, and insurance dilemmas.